See what's coming next in Church Tech - WATCH THE REPLAY

We have a front row seat in the church tech arena. We consistently see churches wondering if mobile giving is too costly or complicated. What the best mobile giving platform is? Or if it’s only for the “techy” folks and younger churches.

It’s with those types of questions and concerns in mind that we decided to compile this comprehensive resource. It’s meant to inform and educate churches, ministries, and faith-based nonprofits about mobile giving. Our goal is that you have the information you need to make fully educated and wise decisions as you are responsible for shepherding the flock under your care.

Regardless of whether you use Tithe.ly mobile fundraising, we hope The Definitive (and Practical) Guide to Effective Mobile Giving for Churches serves as a useful and valuable resource.

This guide is for volunteers, board members, administrators, pastors, church leaders, and anyone else who wants to understand mobile giving and mobile donations in the context of the church.

As our friend, Michael Lukaszewski with Church Fuel stated: “We work with hundreds of pastors all across the country in churches of all shapes and sizes, and nearly every pastor realizes mobile is a really big deal. But even though we know it’s important; it’s still really confusing to a lot of us. That’s understandable because you’re a pastor and not an app builder. That’s why it’s important to partner with someone who knows technology. You focus on what you do best and let someone else help you with the tech side of things.”

We’ve sought to take the mystery out of mobile giving and equip you with information in this guide.

Pastor Mike Morris leads a church in a small Virginia town with about 300 people at services each week. After realizing most of their congregation doesn’t carry a checkbook anymore, they decided it was time for a more modern giving solution. Initially, they rolled it out only to the church leadership team. They wanted to use it for a month to make sure it would be a good fit for their congregation. From there, they announced it to the church over a period of several weeks with emails, videos, and in service announcements. They emphasized the convenience of using something people always have with them, their phone, to give to the church.

The results?

Roughly 40% of giving is now recurring, and for the first time, they’re ahead of budget in the first quarter of the year.

That increase is without any significant change in attendance.

Mobile giving can make a powerful difference at your church. From helping people give more consistently to offering a way to give that’s more convenient, mobile giving can be an incredible tool. We realize the mobile giving landscape can be a bit noisy. From many providers in the market to the different terminology involved, it can be challenging to navigate. Our goal is to cut through the noise and provide you with clear and comprehensive information so you can make the best decision for your church!

To begin, let’s address a few of the concerns people tend to have about mobile giving:

Have these concerns run through your mind when the subject of mobile giving comes up? If so, you’re not alone. Many pastors and church leaders are learning more about mobile giving and wondering if it’s right for them. Is it worth the time and effort to set up? Will their congregations actually use it? These are valid questions we seek to answer in this guide.

We’ve conducted research and interviewed church leaders to answer the most common concerns that come up about mobile giving. We’ve also included information on how to evaluate mobile fundraising providers to help you make an informed decision.

Let’s dive in.

So, what is mobile giving and mobile donations? The The definition of mobile giving is a great place to start! Is it all about having a mobile app or can it be done in other ways? What about text-to-give? These are great questions that come up frequently when people are delving into the world of digital and mobile donating.

To make it super clear, we’ll define mobile giving as the ability to use a mobile device such as a phone or tablet to give to a church, ministry, or nonprofit. Mobile fundraising allows donors to quickly give by entering basic information such as name, email address, and debit/credit card information, along with the amount they want to give. They can do this during the normal offering time or throughout the week as they manage their finances.

It’s convenient and easy to use. But it’s important to remember that there are critical differences between mobile app giving, mobile online giving, and regular online giving.

Mobile giving is actually quite simple. Your church educates members and others who attend by letting them know about your mobile giving app. To learn more about that process see our “Launching mobile giving to your church” section on page 22. Once you’ve educated people, they’ll download your mobile giving app. From there, they set up an account and add their payment method so that giving can happen in seconds. When a donor gives a gift through the mobile giving app, the information is transmitted from the giving app through 256 Bit SSL over the Internet to ensure the data being transmitted is secure. The gift will then go through the various entities involved in payment processing and end up in your church bank account.

The main difference between online and mobile giving is that mobile giving involves using a mobile phone where all user interactions are optimized for the mobile experience instead of a laptop or desktop computer. Also, it’s important to understand that individuals use mobile fundraising more often to donate to churches and ministries because they can give anytime, from anywhere and without being restricted to using a larger device. We typically handle online giving on a desktop or laptop computer through an internet browser (Safari, Internet Explorer, Chrome, etc.). There are, however, a few types of mobile giving: native mobile app, mobile response giving form, and text to give.

A native mobile app is a smartphone application coded in a specific programming language. Users must download native mobile apps from iPhone or Android app stores. Native apps provide fast performance and a high degree of reliability. Giving through a native mobile app allows givers to create an account and store their giving information so they can quickly give a one-time gift, set up recurring giving, manage their payment methods (credit card, debit card, ACH, etc.), and see giving history.

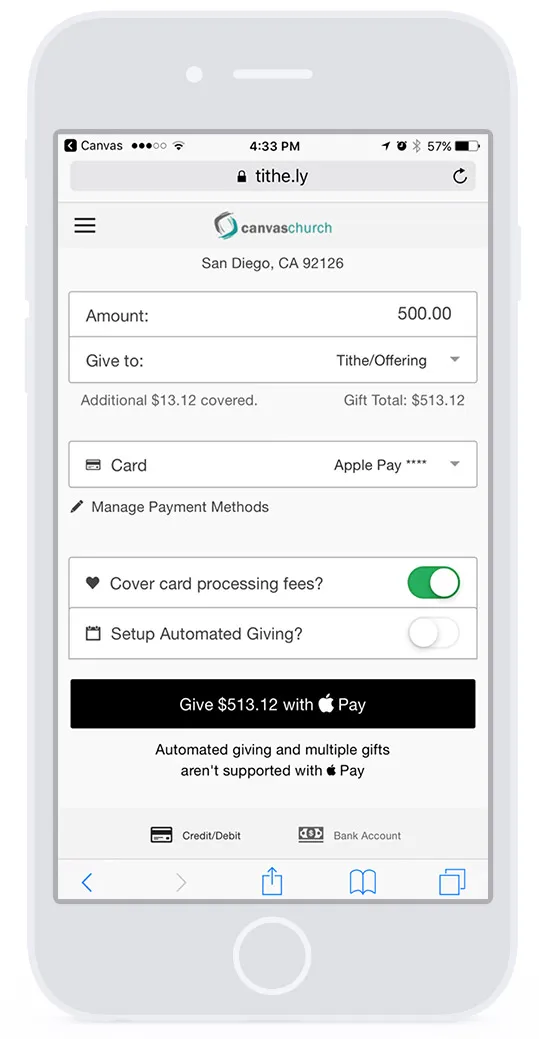

Users typically access a mobile responsive giving form through a mobile web browser on a smartphone. You can think about this as a form you’d normally see on a website using your desktop or laptop but is optimized to look and function well on a mobile device. Givers can easily enter their name, payment method, and gift amount using this form.

Text-to-give (aka text giving) uses a mobile phone’s built-in text capabilities. Your giving provider will assign a nine-digit phone number to your church that can be used to accept donations. In it’s simplest form, donors text a number (e.g., 100) to their church’s dedicated nine-digit text-to-give phone number and their gift is complete. Donors can also text commands like “50 weekly tithe” to give $50 a week to the tithe fund for your church.

Try a quick experiment during church services next week. Ask everyone to raise their hand if they have their phone with them. Next, ask who has their checkbook with them. Most likely, the number of hands raised will dramatically decrease between the first and second question.

Don’t just take our word for it. According to Pew Research Center, 77% of Americans own a smartphone. It’s not just the younger generation that’s embraced smartphone technology. Of Americans 65+, 42% have a smartphone. Of those 50-64, 74% have a smartphone.7

You know they have their phones with them at church (and everywhere else they go).

Since they’re more likely to have their phone than checks or cash, it makes sense to offer a giving option that involves a mobile phone.

How much cash is in your wallet right now? If you’re like nearly 50% of Americans, you carry less than $20 in cash most days. Expand that number to your congregation, and it’s hard to justify relying on them to have cash available for a Sunday morning offering.

They may not carry much cash, but they have a checkbook on them, right? Not likely. According to a recent study by the Federal Reserve, the number of checks written has declined 9.2 percent from 2009 to 2012.4 In a 2014 survey, GOBankingRates found that 38% of respondents “never” write personal checks. Only 26% stated they write a check “several times a month.”5

What apps do you have on your phone? You may have your bank’s app so you can check your account balance, pay bills, and schedule transfers between checking and savings. You might have the Amazon app to buy that book you’ve meant to read.

In a 2016 report by the Federal Reserve, 28% of smartphone owners made purchases using their phone. 53% used their phone to conduct banking transactions.8

Perhaps you’ve used Apple Pay or the Starbucks app to buy coffee on the way into work this morning. You may even be using Venmo to send money to friends. If so, you’re in good company.

This isn’t a factor we like, but it’s a reality we must face. In a recent Gallup poll …

26% of respondents stated they attend a church or synagogue every week.

That number has declined 5% from 31% in 2012.9 Those who are part of your congregation but don’t attend regularly can still have the opportunity to give via a mobile app.

They may not come to the church service every week, but they still might watch the live stream or podcast while traveling for business or when they need to stay home with a sick child. By providing a mobile fundraising option, you’re removing potential barriers to giving of having to tithe via cash or check in-person.

Creating the ability for someone to give at any moment regardless of location or time of day makes giving as convenient as humanly possible. Paying your bills and want to give your tithe? Go for it. Listening to a sermon and feel inspired to give? Go for it. Just got paid and want to give your first to God? Click, click, give.

In addition to the general convenience of using a mobile app to give one-time gifts, a mobile giving app makes it simple for donors to setup automated recurring giving on a weekly, monthly, or bi-monthly basis. When donors do this, your church can rely on more predictable revenue that’s setup to automatically come in.

The process of counting, preparing the deposit, and recording cash and check donations is time-consuming. As your congregation starts giving via a mobile app instead of cash or check, you reduce the volume of work your accounting team deals with each week. This is a huge benefit as often volunteers help count contributions on a weekly basis.

Wouldn’t you rather your volunteers and admin staff spend their time on more valuable things?

Also, a good mobile giving app provider will provide the ability to export transactions from the administration console into a file format that’s easily uploaded to your accounting software, so your team spends less time doing manual data entry.

When people give to your church, they are placing their trust in church leadership to handle and use that money wisely. They’re also trusting that you have processes in-place to protect their credit, banking, and otherwise personal information. Mobile donations have an advantage over checks or cash when it comes to securing data and preventing fraud.

Mobile giving uses specific protocols to secure the giver’s data. If you ask givers who want to give via debit/credit card write their card information on a tithe envelope, those numbers aren’t secure. Anyone could take that envelope and use the information to make fraudulent purchases. When people give via a check, their bank account and routing number are easy to see and use.

Wise church leaders have a process for collecting the offering, getting it to a secure room, and ensuring multiple people are in the room at all times while counting and preparing the offering for deposit. However, there’s still the risk of human error or outright theft. No one likes to think their staff or volunteers are capable of doing such a thing, but you owe it to your givers to put the best practices in-place to protect their financial information.

Mobile fundraising is more efficient and secure for your staff when it comes to keeping accurate records of gifts.

Since the giver entered his/her information into the form, that’s one less task your staff has to handle. Giving information is maintained within the mobile giving platform administration console which givers can view themselves to see their giving history and update their payment methods. Your staff also has the option of exporting giving records and importing it into your church’s accounting software. This reduces time spent on data entry and the possibility of data entry errors.

We add this one slightly tongue-in-cheek, but with a hint of seriousness. God chose the church as His way to reach the world, and we should do things that draw people to our churches. It may sound funny, but having a great mobile giving app will speak to certain types of people.

78% of churches accept online donations while only 36% have implemented giving by mobile.

Those who give on a regular basis, at least once a month, make up roughly 15% of the total population. However, their gifts account for about 51% of the total dollars given.1 By providing users with an easy way to setup recurring giving, you help maintain and increase giving consistency.

We’ve found that when a church leader fully supports mobile giving, and the staff follows a robust rollout program, they’ll see at least a 10% increase in giving over a six month period.

Ray Schalk, Director of Administration for San Diego Church of Christ mentioned that mobile donation capabilities, “engage the younger generation that may or may not have given on a regular basis.” Since they don’t typically carry a checkbook and are accustomed to using their mobile phone for financial transactions, mobile fundraising makes sense to them. Ray also mentioned they noticed an increase in recurring givers. That’s the bigger contributor to the increase in donations for their church.

What apps do you have on your phone? You may have your bank’s app so you can check your account balance, pay bills, and schedule transfers between checking and savings. You might have the Amazon app to buy that book you’ve meant to read.

In a 2016 report by the Federal Reserve, 28% of smartphone owners made purchases using their phone. 53% used their phone to conduct banking transactions.8

Perhaps you’ve used Apple Pay or the Starbucks app to buy coffee on the way into work this morning. You may even be using Venmo to send money to friends. If so, you’re in good company.

When you meet people where they’re at by using a tool they carry with them 24/7, you make it easier for them to consider giving throughout the week. Joe might see your church’s Facebook post about an upcoming outreach to lower income families and decide he wants to help. He can go into the app (since he’s already on his phone checking Facebook) and make a donation. You’re capturing their attention and providing them with a convenient way to give in the moment.

It makes being a generous giver part of everyday life instead of something they only consider on Sunday morning.

Mobile giving is extremely convenient for your congregation. They can certainly give on Sunday morning, but they also have the flexibility to give throughout the week.

If Susan reviews her finances on Fridays, she can quickly give using a mobile app when she realizes she can give a bit extra this month. If she gets paid on the 1st and it’s a Wednesday, she can give the first fruits of her paycheck. If she’s listening to last week’s sermon and feels compelled to give, she can do so right from her phone. Tithe.ly’s giving research indicates that 67% of giving happens Monday-Saturday.1

Also, people give using a mobile app at all times of the day and night. Over 30% of giving dollars come in between 9pm and 6am.1Those who’re donating during that timeframe might be watching a service online and feel led to give at that moment. Providing potential donors with the ability to give at any time opens up the possibility for increased donations and more consistent giving.

Here’s the deal: When evaluating a mobile giving app, simply looking at the “processing fees” won’t give you the complete picture. You have to look at the processing fees and all other associated fees to understand your true all-in cost. In many cases, churches are paying much more than they think due to not understanding how all the fees apply.

An easy way to make sense of the fees being assessed is to calculate your all-in effective rate.

Here’s a simple formula to help you get to the bottom of things:

.

78% of churches accept online donations while only 36% have implemented giving by mobile.

A good rule of thumb is that your effective rate should be about 3% or less. In other words, out of a $100 gift, your church should receive approximately $97 after all fees.

Another thing to consider is if a provider offers volume discounts. Let’s say your church initially processes at least $25,000 with them each month, and that grows to $35,000 per month after six months. Will the provider charge you a lower rate since you’re now processing more transactions with them?

If you are shopping for a mobile giving app, you’ll want to ask about volume-based discounts for the future. A good provider will reward you with lower rates as you grow with them.

Total raised in a given month: $10,000

Total fees in a given month: $349

Effective Rate: $309 (fees) / $10,000 (gross raised) = 3.09%

If you’re looking on a vendor’s website and see 2.5% as the fee, but then have the additional costs, you’ll quickly be able to see that the real price per transaction isn’t 2.5%. In our example, it would be 3.09%!

NOTE: The above does NOT reflect Tithe.ly pricing. See the Tithe.ly pricing page for more information our our rates and costs.